digital-set.ru Market

Market

Things You Can Invest In To Make Money

Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest. Another way is to make a return by. But we can give you an idea of what can be achieved. Fixed-rate savings bonds are among the surest ways to see growth on your savings – in return for locking. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Again, these funds might seem trivial, but it's income you're not likely to miss. And over time, if invested properly, these cash-back rewards can make a. While lenders give you money under the assumption that you'll repay it with interest, investors give you money in exchange for partial ownership of your. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. One can invest in many types of endeavors (either directly or indirectly), such as using money to start a business or in assets such as real estate in hopes of. This means that if things go well, high-risk investments can produce high returns. But if things go badly, you could lose all of the money you invested. And. The investing world has two major camps when it comes to how to invest money: active investing and passive investing. Both can be great ways to build wealth as. Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest. Another way is to make a return by. But we can give you an idea of what can be achieved. Fixed-rate savings bonds are among the surest ways to see growth on your savings – in return for locking. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Again, these funds might seem trivial, but it's income you're not likely to miss. And over time, if invested properly, these cash-back rewards can make a. While lenders give you money under the assumption that you'll repay it with interest, investors give you money in exchange for partial ownership of your. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. One can invest in many types of endeavors (either directly or indirectly), such as using money to start a business or in assets such as real estate in hopes of. This means that if things go well, high-risk investments can produce high returns. But if things go badly, you could lose all of the money you invested. And. The investing world has two major camps when it comes to how to invest money: active investing and passive investing. Both can be great ways to build wealth as.

No one can guarantee that you'll make money from investments you make. But if you get the facts about sav- ing and investing and follow through with an. Buy government securities like Treasury bills, Treasury bonds, Treasury notes, Central government bonds and Municipal bonds among others. You. Embrace lifelong learning. Education doesn't end once you leave the classroom, and you can build your skill set and feed your passions with lifelong learning. They might want you to invest money in stocks, bonds, notes, commodities, currency, or even real estate. A scammer may lie to you or give you fake information. Some choices might include; - futures contracts (lumber, coffee, pork bellies, silver, etc) - physical commodities (metals in particular) - start up businesses. Being busy with your job, profession or business, you might not have the time to follow the stock market and make any direct investments. This is where mutual. We'll also give you our best advice for choosing financial advisors. Best way To Invest Money In Canada By Andrew Goldman. All the fundamentals the. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Investing in stocks is one of the most important financial skills you need to master. On average, stocks have given an annualized return of around 10%. At that. How can I use it? Set money aside now, while you're still working, to use when you retire. What is it? A registered investment plan where. Armed with this knowledge, investors are better equipped to make informed decisions that could shape their investment journey and financial future. Proceed to. The investing world has two major camps when it comes to how to invest money: active investing and passive investing. Both can be great ways to build wealth as. Investing in government and corporate bonds. Government and corporate bonds are considered the safest option as they offer a fixed rate of return. The advantage. For example, if you had an all-stock portfolio, you could invest in large-cap, small-cap, and international companies. You could further diversify your holdings. Creating and uploading icons, elements, and other digital resources to contributor platforms like Canva, Adobe Stock, and FreePik can be quite lucrative. Many. Hedge funds require large minimum investments or a high net worth. You have to be wealthy to buy in. Hedge fund investors pool their money and often make high. While you could simply add that cash to your savings for short-term goals, now may be the time to consider investing for longer-term goals by buying individual. Audit your expenses and the attitude to the spending. Don't spend money on things you don't quite need or can't afford. 9. SAVE 10% FROM EACH PAYCHECK. One way investments generate income is through dividends. If you have invested in a company by buying shares, for example, that company may pay you a small.

Buying A House For Investment Purposes

The main advantage of owning real estate as an investment over other investments, such as stocks, is leverage. You can own an investment property with a. In real estate, this means that a property is only a good investment if it will generate at least 2% of the property's purchase price each month in cash flow. How is owning a primary residence a “good investment”? · It gives you a fixed housing cost long term. Rent can and does go up all the time. 7 Things to Do Before Buying an Investment Property · 1. Don't Underestimate the Costs · 2. Get an Honest Real Estate Agent · 3. Spring for a Home Inspection · 4. An investment property is a good source of steady income when done correctly. Learn what an investment property is and things to consider before buying. Buying property also has a high-value entry point compared to other investments. To purchase a home the minimum investment is often hundreds of thousands of. Banks have tougher lending requirements for investment properties than for primary residences. They assume that if times get tough, people are less inclined to. Buying investment properties can come with a unique set of potential risks and rewards. · Risks can include the cost of ongoing time and effort to manage. Understand also that investment loan to buy a property requires a higher down payment in the % range with a lot of hoops to jump through. The main advantage of owning real estate as an investment over other investments, such as stocks, is leverage. You can own an investment property with a. In real estate, this means that a property is only a good investment if it will generate at least 2% of the property's purchase price each month in cash flow. How is owning a primary residence a “good investment”? · It gives you a fixed housing cost long term. Rent can and does go up all the time. 7 Things to Do Before Buying an Investment Property · 1. Don't Underestimate the Costs · 2. Get an Honest Real Estate Agent · 3. Spring for a Home Inspection · 4. An investment property is a good source of steady income when done correctly. Learn what an investment property is and things to consider before buying. Buying property also has a high-value entry point compared to other investments. To purchase a home the minimum investment is often hundreds of thousands of. Banks have tougher lending requirements for investment properties than for primary residences. They assume that if times get tough, people are less inclined to. Buying investment properties can come with a unique set of potential risks and rewards. · Risks can include the cost of ongoing time and effort to manage. Understand also that investment loan to buy a property requires a higher down payment in the % range with a lot of hoops to jump through.

Primarily, this means a real estate investor who buys rental property to rent to a tenant to earn rental income. Although, it can also mean someone buying an. Borrowing money to buy If you borrow to invest, you will have to pay the property mortgage. Don't rely on rental income to cover the mortgage – there may be. As a rule of thumb, buy-and-hold real estate investors normally make a down payment of around % when financing an investment property. Steps to take when buying investment property · Obtain mortgage preapproval. · Crunch the numbers. · Consider all the costs. · Scrutinize tenant quality. An investment property is a good source of steady income when done correctly. Learn what an investment property is and things to consider before buying. How is owning a primary residence a “good investment”? · It gives you a fixed housing cost long term. Rent can and does go up all the time. Crowdfunded capital lets you achieve your investment goals while maintaining financial control. With the right strategy and research, you can find a. 1. Secure your financing. Unless you have a lot of cash sitting around, you need to line up financing for your rental property acquisition. Buying an investment property · Work with a realtor to find your ideal investment property, and then draft an offer to purchase. We recommend working with a. Primarily, this means a real estate investor who buys rental property to rent to a tenant to earn rental income. Although, it can also mean someone buying an. If the house you buy is sound, increases in value and you're able to collect enough rental income to pay the mortgage, taxes, insurance and. The home remains in a good location, even over time. And the property has the ability to serve multiple purposes if needed since life doesn't always follow the. 1. Secure your financing. Unless you have a lot of cash sitting around, you need to line up financing for your rental property acquisition. It is not a coincidence that stocks offer higher returns, as investors must accept more heartache in order to capture those returns. The short-term (relative). How will you finance the purchase? “Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard. Diversify and reduce risk with hassle-free real estate investment for consistent returns without the headaches. · Consistent passive income · Property. Our Investment Property Program allows for qualified borrowers to purchase an additional investment property with a minimum of 20% down. Yes, if you buy a property solely as an investment, you will need to take out an investment loan. And those do require higher down payments than a a loan to. Real estate investing involves purchasing an investment property to generate profit. An investment property is real estate that isn't a primary or secondary. 1. Location. Location is critical when buying a property for investment purposes. · 2. Rental Yield · 3. Property Condition · 4. Exit Strategy · 5.

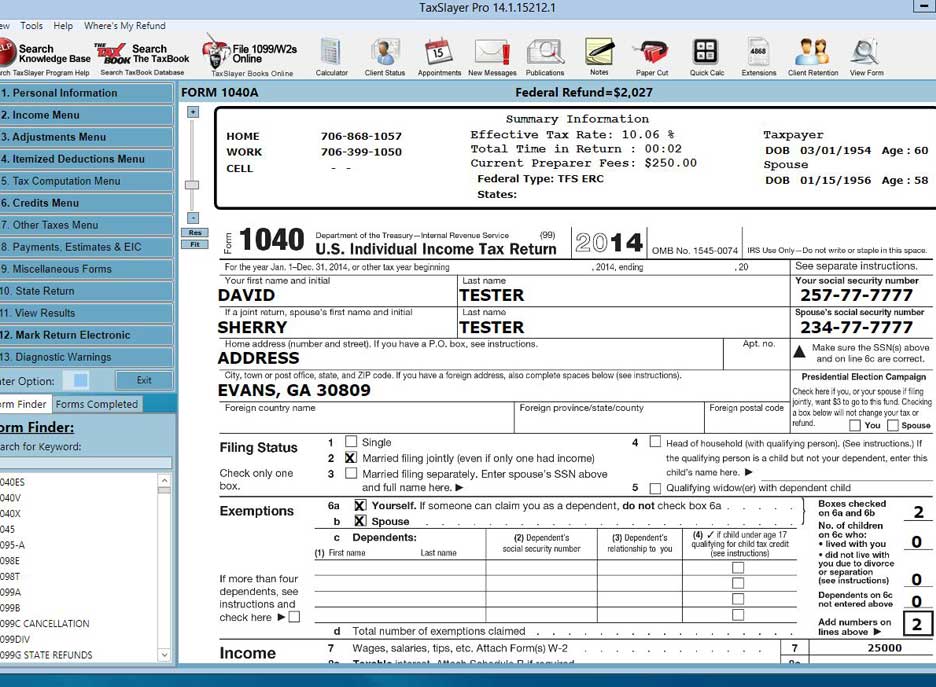

Offline Tax Preparation Software

Cash App Taxes, formerly Credit Karma Tax, is a free online tax preparation service. Cash App also offers a mobile payment service that allows users to send. Free Tax Preparation Assistance · File an Extension · Paying Tax Owed · Amend Online - purchase software to prepare your taxes or, if eligible, use Free File. All-inclusive professional tax software TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' tax returns. FREE Evaluation! TRY IT FREE. OLTPRO, Professional Tax Software Designed to Individual pricing structures for the Professional Tax Preparer. client. Instead of helping you prepare and file your federal tax return, the IRS2Go app is a free tool for checking your refund status, making electronic payments to. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. Sprintax Calculus is the engine behind our multi-jurisdiction, tax compliance software which simplifies payroll processing for nonresident employers. Approved Third Party Software for Individual Income Tax (IIT) Filers ; com. Product Name: com. Website: wwwcom ; Now Product Name: Now. Drake Software is a complete professional tax preparation program for federal and state returns, business and individual. See why professional preparers. Cash App Taxes, formerly Credit Karma Tax, is a free online tax preparation service. Cash App also offers a mobile payment service that allows users to send. Free Tax Preparation Assistance · File an Extension · Paying Tax Owed · Amend Online - purchase software to prepare your taxes or, if eligible, use Free File. All-inclusive professional tax software TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' tax returns. FREE Evaluation! TRY IT FREE. OLTPRO, Professional Tax Software Designed to Individual pricing structures for the Professional Tax Preparer. client. Instead of helping you prepare and file your federal tax return, the IRS2Go app is a free tool for checking your refund status, making electronic payments to. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. Sprintax Calculus is the engine behind our multi-jurisdiction, tax compliance software which simplifies payroll processing for nonresident employers. Approved Third Party Software for Individual Income Tax (IIT) Filers ; com. Product Name: com. Website: wwwcom ; Now Product Name: Now. Drake Software is a complete professional tax preparation program for federal and state returns, business and individual. See why professional preparers.

Simplify your tax prep with TaxAct. Our comprehensive tax preparation solutions make filing taxes fast, easy, and accurate. Recommended offline software to complete tax forms I have used Turbo Tax for years. But the last few years I feel they have reached too far. Tax Preparation Software for Tax Professionals. SINCE Taxware Systems offers a full line of tax software designed for tax preparers by tax preparers. Services provides a free tax prep software, Glacier Tax Prep (GTP). However, this software does not become available until mid-February. Filing Taxes. Filing. Our Top Tested Picks · Intuit TurboTax (Tax Year ) · H&R Block (Tax Year ) · FreeTaxUSA (Tax Year ) · TaxAct (Tax Year ). Sprintax is a tax return preparation software program designed primarily for nonresident alien students, scholars, trainees, researchers, and other educational. While the IRS Direct File program is for federal returns only, Arizona chose to join the pilot program, providing a service that integrates state tax filing. Learn more about H&R Block's Deluxe + State tax preparation Software to Your tax prep is free. % Satisfaction Guarantee. Unhappy with our tax. IRS Free File partners are online tax preparation companies which provide free electronic tax preparation and filing of federal tax returns at. Recommended offline software to complete tax forms I have used Turbo Tax for years. But the last few years I feel they have reached too far. Prepare your taxes for easy online filing this April with TurboTax and H&R Block tax software programs for your PC or Mac computer. UltraTax CS, the professional tax software from Thomson Reuters, will streamline and automate your entire tax prep workflow. Request your free demo today! The Deluxe online version including live chat and AI assist is $55 plus $49 per state. H&R Block also has tax preparation software downloads starting at $35 and. H&R BlockIntuit TurboTaxAll computer softwareShop all tax softwareShop all tax prep tech Tax Return - Physical Disk & Download - BONUS FREE Dr OTC USB Drive. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can prepare. Probably the most comprehensive and intuitive tax filing software available for Americans abroad in the market. If you have questions, their e-. Easy, accurate online tax filing for less · Simple, step-by-step instructions and free live chat support. · File when and where you want on desktop or mobile. However, you can still file your federal and state income taxes for free online or in person using NYC Free Tax Prep. If you owe the government money, be. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. Cloud-based tax preparation software · Ready to prepare returns from wherever you are? · Features · Request your free cloud-based demo of TaxSlayer Pro today!

Amortization Table Calculation

Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. According to the amortization table, $1, financed at 6% interest for 30 years results in a monthly payment of $ Multiplying this factor of $ by Calculator Use. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Calculate Principal and Interest Payments Over Time. This loan amortization calculator figures your loan payment and interest costs at various payment intervals. The following mathematical formula can also be used to calculate the loan payments and to construct an amortization schedule. instalment payment. = PV x i x. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. The amortization table provides a monthly breakdown of the principal, income, expenses, and capital for each loan priced in your opportunity. How Do I Calculate Amortization? To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. According to the amortization table, $1, financed at 6% interest for 30 years results in a monthly payment of $ Multiplying this factor of $ by Calculator Use. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Calculate Principal and Interest Payments Over Time. This loan amortization calculator figures your loan payment and interest costs at various payment intervals. The following mathematical formula can also be used to calculate the loan payments and to construct an amortization schedule. instalment payment. = PV x i x. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. The amortization table provides a monthly breakdown of the principal, income, expenses, and capital for each loan priced in your opportunity. How Do I Calculate Amortization? To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know.

A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. Guide to Amortization formula, here, we discuss its uses, practical examples, and Calculator with a downloadable Excel template. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Simply input your loan amount, interest rate, loan term and repayment start date then click "Calculate". Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Amortized Loan: Paying Back a Fixed Amount Periodically Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student. Amortizing Loan Calculator. Enter your desired payment - and the tool will calculate your loan amount. Or, enter the loan amount and the tool will calculate. Amortization takes into account the total amount you'll owe when all interest has been calculated, then creates a standard monthly payment. How much of that. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. How to calculate amortization · Step 1: Convert the annual interest rate to a monthly rate by dividing it by · Step 2: Multiply the loan amount by the monthly. Monthly Loan Calculator with Amortization. Principal. Amortization months. Help. Interest Rate. About. Or input payment. and. For illustrative purposes only. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Use our mortgage amortization calculator to see the schedule of your mortgage payments, breaking down principal and interest over time..

Overbought Stock Screener

A stock with an RSI above 70 is considered overbought and likely to experience a price decline. In contrast, a stock or other asset with an RSI below 30 is. An overbought stock doesn't trade at its true worth. Instead, it's trading over what it should. When a stock price rises too far (at a pace that is too fast and. These stocks if held in the portfolio might be overbought. Time to book some profit. by Sushanta. results found: Showing page 1 of Screener: Discover stocks exhibiting overbought signals on both RSI and MFI with the Screener. Explore 5paisa's Screener for deep insights and strategic. Stock Screener app for android is free and searches the US stock market based on technical analysis and stock chart patterns for stock trading. Day RSI indicates these high volume stocks are in an overbought territory. When the RSI goes above the 70 level, the common interpretation is that the trend. Stocks with Relative Strength Index (RSI) above 70 are considered overbought. This implies that stock may show pullback. RSI Fast Overbought Screener on Daily (EOD) Tick. RSI calculates strength of stock trend and helps to predict their reversals. FuturesAndOptions. Overbought Stocks ; 1. Addictive Learn, ; 2. Nestle India, ; 3. Tuticorin Alkali, ; 4. Teerth, A stock with an RSI above 70 is considered overbought and likely to experience a price decline. In contrast, a stock or other asset with an RSI below 30 is. An overbought stock doesn't trade at its true worth. Instead, it's trading over what it should. When a stock price rises too far (at a pace that is too fast and. These stocks if held in the portfolio might be overbought. Time to book some profit. by Sushanta. results found: Showing page 1 of Screener: Discover stocks exhibiting overbought signals on both RSI and MFI with the Screener. Explore 5paisa's Screener for deep insights and strategic. Stock Screener app for android is free and searches the US stock market based on technical analysis and stock chart patterns for stock trading. Day RSI indicates these high volume stocks are in an overbought territory. When the RSI goes above the 70 level, the common interpretation is that the trend. Stocks with Relative Strength Index (RSI) above 70 are considered overbought. This implies that stock may show pullback. RSI Fast Overbought Screener on Daily (EOD) Tick. RSI calculates strength of stock trend and helps to predict their reversals. FuturesAndOptions. Overbought Stocks ; 1. Addictive Learn, ; 2. Nestle India, ; 3. Tuticorin Alkali, ; 4. Teerth,

Technical analysis screener for Overbought RSI + Stochastic, ideas for the best stocks to buy today displayed in easy to view tables. List of the overbought stocks selected by the results of the technical analysis over the past six months. The list intend to help find stocks that are. An overbought stock is one that is overvalued, which means the outlook is bearish as there will be a pullback on the stock soon, meaning its price will fall as. Screener (One Hour Period) -Overbought By Falling Smooth Relative Strength index (RSI Smooth). Data is Refreshed Every Minute During trading Hours. These scans find stocks which can be considered overbought based on Stochastic or by being at or above the upper Bollinger Band. It's critical to note that. A stock is oversold when the RSI is below This list is generated daily, ranked based on market cap and limited to the top 30 stocks that meet the. Overbought stock screener to scan for a list of the most overbought stocks trading on the NYSE, NASDAQ and AMEX. The overbought stocks list is scanned based. Stock screener for investors and traders, financial visualizations. A stock screener allows you to sift through the thousands of stocks in the market and narrow down to the handful of stocks that matter to you. When a stock is oversold, analysts mean that its price has gone too far in a negative direction. They base this on both fundamental and technical indicators. When the technical indicator RSI is above 70, a stock is considered an overbought stock. When the RSI indicator drops from 70, it generates a bearish signal. We use a technical indicator called the RSI to measure when a stock is overbought. When the technical indicator RSI is above 70, a stock is considered an. Technical Stock Screener - Overbought / Oversold ; Overbought Relative Strength Index (RSI) View Help · 24 · 37 ; Overbought Williams' Percentage Range (W%R) View. Technical stock screener to scan the US stock market for profitable trade setups. RSI Stock Screener - allows you to find oversold and overbought stocks and. Crossover when daily RSI crosses above 30(oversold) OR RSI crosses below 70(overbought) Technical & Fundamental stock screener, scan stocks based on rsi. RSI - Oversold Stocks · 1. Spright Agro, , , , , , , , , , · 2. Inspirisys Sol. , If the RSI Value is over 70, it is considered as overbought. Similarly, if the RSI Value is below 30, it is considered as oversold. Features Available In RSI. Screen What Stocks are overbought and oversold with our Relative Strength Index Screener. About Overbought Stock Screener. The top of overbought stocks is the results of volume-price based technical analysis over the past six month. Technical Analysis: Stocks with Relative Strength Index (RSI) above 70 are considered overbought. This implies that stock may show pullback. Some traders, in an.

Can Nurses Get Student Loan Forgiveness

Can nurses get their student loans forgiven? Yes, nurses can qualify for student loan forgiveness through programs like Public Service Loan Forgiveness (PSLF). You may avoid this through one of multiple student loan forgiveness programs. These exist to help nurses like you reduce the repayment period by wiping out a. Nurses can receive up to $27, per year in loan forgiveness, depending on their position and location. Interestingly, employers must match the loan. It's important to note that these favorable repayment options are only available to individuals who have not yet served in the military. Similar to other. The Bachelor of Science in Nursing Loan Repayment Program (BSNLRP) increases the number of appropriately trained Registered Nurses providing direct patient. Student loan forgiveness for nurses is the opportunity for borrowers who become nurses to have their federal loans discharged through national or state programs. To qualify for loan forgiveness, you must first graduate from the program for which you received financial assistance, obtain licensure from the North Carolina. The Public Service Loan Forgiveness (PSLF) Program · You must be a US citizen · You must also have eligible loans; private student loans (if any) and federal. Under this program, nurses with Perkins Loans—low-interest loans for students with exceptional financial need—may qualify for % forgiveness if they've worked. Can nurses get their student loans forgiven? Yes, nurses can qualify for student loan forgiveness through programs like Public Service Loan Forgiveness (PSLF). You may avoid this through one of multiple student loan forgiveness programs. These exist to help nurses like you reduce the repayment period by wiping out a. Nurses can receive up to $27, per year in loan forgiveness, depending on their position and location. Interestingly, employers must match the loan. It's important to note that these favorable repayment options are only available to individuals who have not yet served in the military. Similar to other. The Bachelor of Science in Nursing Loan Repayment Program (BSNLRP) increases the number of appropriately trained Registered Nurses providing direct patient. Student loan forgiveness for nurses is the opportunity for borrowers who become nurses to have their federal loans discharged through national or state programs. To qualify for loan forgiveness, you must first graduate from the program for which you received financial assistance, obtain licensure from the North Carolina. The Public Service Loan Forgiveness (PSLF) Program · You must be a US citizen · You must also have eligible loans; private student loans (if any) and federal. Under this program, nurses with Perkins Loans—low-interest loans for students with exceptional financial need—may qualify for % forgiveness if they've worked.

There is a “loan forgiveness” program for nurses. However I have never met any nurse who was granted any relief under this student loan program. The public service loan forgiveness for nurses is a government program that forgives a portion of the loans accumulated by nurses who are working full time for. Primary sources for student loans designed specifically for nursing students are government sources and schools of nursing themselves. Nursing student loans are. RNs can apply for both state and federal loan forgiveness programs. Under certain conditions, you may have all or part of your education loans forgiven or. The PSLF is Public Service Loan Forgiveness—those who work in public services like nursing and work for a non profit company may be able to have. Maximum Loan Repayment Amounts Awarded per Year · $10, for eligible Registered Nurses (RN) · $20, for eligible Advanced Practice Nurses (APN, NP, CRNA. Yes, nurses can have their student loans forgiven through various programs designed specifically for healthcare professionals. These programs aim to alleviate. Can nurses get their student loans forgiven? Yes, nurses can qualify for student loan forgiveness through programs like Public Service Loan Forgiveness (PSLF). You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job. Nursing faculty in New York State can apply for student loan forgiveness. Registered nurse licensed to practice in NYS. Qualified as nursing faculty or adjunct. You must also be a licensed registered nurse or nurse faculty, have completed training, and be employed full time at an eligible critical shortage facility. The SLRN Program will benefit nurses who have worked and continue to work tirelessly to fight the COVID pandemic. Individuals eligible to participate in the. Those nurses who are working for non-profit organizations or governmental bodies are eligible for Public Service Loan Forgiveness. In order to qualify for PLSF. Alternatively, a nurse can have loans forgiven by working at an accredited nursing school. Public Service Loan Forgiveness. The Public Service Loan Forgiveness. How to Qualify: Apply through the school that provided your Perkins loan. Applicants must be full-time registered nurses to be eligible for student loan. ONA knows that nurses desperately need relief from their student loans. As the most trusted profession in the United States, nurses have always been willing. Travel nursing isn't a loan forgiveness program per se. However, many nurses find themselves drawn to traveling because of the incredibly competitive. If you're a nurse struggling under a mountain of student loan debt, there are a few forgiveness programs you may consider. Contact McCarthy Law today! Nurses who work in specific fields or locations may also be eligible for student loan forgiveness. For example, nurses who work in public schools or in areas. advanced practice registered nurses: $16, Are My Loans Eligible? To qualify for repayment through this program, a loan must: have been used to pay.

How To Purchase Silver Online

Buy Silver and Gold from SilverTowne. Precious Metal Prices updated real-time. Best place to buy silver since Free Shipping on orders $99+. Buy physical gold, silver and platinum bullion, coins and bars online through TD Precious Metals Digital Store. Convenient delivery to your front door or a. With DIGIGOLD there is no lock-in so you can buy,store, sell & gift your silver anywhere, digitally. Learn how to buy physical silver online with guides on the best places to purchase coins, rounds, proofs, bars and other real investment silver. We offer our investors the option of using these assets to purchase physical gold and silver, via Bitcoin. If you have another coin, many exchanges and other. You can buy Silver in digital form through Augmont. This company sells Digital Gold and Silver. You can take physical delivery of Gold and. Physical silver can commonly be purchased online, though local dealerships or pawn shops may also offer carry physical silver. If you're looking to buy. Some reputable sites to buy from are HeroBullion, MonumentMetals, SDBullion, JMBullion and of course APMEX but they are really expensive. Use. Buy silver from one of the leading distributors of U.S. government-issued precious metals. Order silver bullion and proof coins today. Buy Silver and Gold from SilverTowne. Precious Metal Prices updated real-time. Best place to buy silver since Free Shipping on orders $99+. Buy physical gold, silver and platinum bullion, coins and bars online through TD Precious Metals Digital Store. Convenient delivery to your front door or a. With DIGIGOLD there is no lock-in so you can buy,store, sell & gift your silver anywhere, digitally. Learn how to buy physical silver online with guides on the best places to purchase coins, rounds, proofs, bars and other real investment silver. We offer our investors the option of using these assets to purchase physical gold and silver, via Bitcoin. If you have another coin, many exchanges and other. You can buy Silver in digital form through Augmont. This company sells Digital Gold and Silver. You can take physical delivery of Gold and. Physical silver can commonly be purchased online, though local dealerships or pawn shops may also offer carry physical silver. If you're looking to buy. Some reputable sites to buy from are HeroBullion, MonumentMetals, SDBullion, JMBullion and of course APMEX but they are really expensive. Use. Buy silver from one of the leading distributors of U.S. government-issued precious metals. Order silver bullion and proof coins today.

We offer a range of gold and silver products which retail clients can purchase through any RBC branch. , , digital-set.ru is an online information. Buy + Purest Silver Bars online weighing 20 gm, 50 gm, gm & gm from LBMA Accredited MMTC-PAMP. Shop Online for Silver Bars with Finest Swiss. Buy silver is easy from Au bullion online platform. Select type whether silver bars, Silver tubes, Silver coins or silver rounds and simple checkout! Buy Gold, Silver and Platinum bullion online. Monthly deliveries from the industry leading precious metal retailer. Discreet and fast shipping. Buy Gold, Silver, and Platinum bullion online at JM Bullion. FREE Shipping on $+ Orders. Immediate Delivery - Call Us - BBB Accredited. Buy Silver Online in Canada - Canadian Bullion Services provides Silver Bullion for sale silver Coins, Rounds, Wafers and Bars, buy silver eagles. In conclusion, whether you buy from local coin shops or online platforms like Preserve Gold, research and select a reputable dealer. Preserve. buy & sell silver bars at philoro. ✓Online purchase and store pickup possible. ✓Discreet and anonymous. ✓Winner in Focus Money test. Buy Silver online from BullionMax. FREE Shipping on $+ Orders. Shop our unbeatable wholesale prices now - Call Us () An individual will have to register himself/herself first and can purchase silver online, though one might have to pay brokerage or commission for such. Kitco makes it easy to buy and sell gold coins, silver bars, and other precious metals. Kitco is world renowned and trusted since They are available for purchase on the national spot exchange trading platform which can be accessed by members of NSEL or franchises. It is required for any. You can buy silver through an online retailer and pay for shipping, all from the comfort of your home. Social media marketplaces are available, but this is not. They are available for purchase on the national spot exchange trading platform which can be accessed by members of NSEL or franchises. It is required for any. Buy Gold, Silver & Platinum Bullion Coins and bars online at the trusted leader in precious metals. Fast, free secure shipping with the lowest prices. BUY SILVER ONLINE Silver often plays a supporting role to gold when it comes to precious metals ownership, but it provides many of the same benefits as the. Live Gold and Silver Prices in USA. Bullion Exchanges - Your Precious Metals Retailer. Types: Gold, Silver, Platinum, Palladium, Rare Coins and Bars. Investing in silver bullion can be done through various platforms, such as online precious metals dealers, physical retail stores, and commodities exchanges. Buy gold and silver coins online. Lear Capital has physical gold for sale, precious metals investments, IRAs and more. We have experts online to help those. buy & sell silver bars at philoro. ✓Online purchase and store pickup possible. ✓Discreet and anonymous. ✓Winner in Focus Money test.

Best Ways To Consolidate Debt

How to consolidate credit card debt · 1. Balance transfers · 2. Personal loans · 3. Retirement plan loans · 4. Debt management plans · 5. Home equity loans (HELs) · 6. Using a balance transfer card to consolidate debt. A balance transfer is a way of moving existing debt from one or more credit cards to a single, cheaper card. This step-by-step guide will teach you all the tips and tricks you need to know to help you get out of debt faster and get back to your life. Can I consolidate my credit card debt by transferring the balance? · Check you will not pay more than you need to once the offer expires · Read the terms and. The best way to consolidate credit card debt varies by individual. It largely depends on your financial circumstances and preferences. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan. Federal Student Aid. One method is debt consolidation: You combine your debts “under the same roof” with a better interest rate and a single monthly payment. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover. How to consolidate credit card debt · 1. Balance transfers · 2. Personal loans · 3. Retirement plan loans · 4. Debt management plans · 5. Home equity loans (HELs) · 6. Using a balance transfer card to consolidate debt. A balance transfer is a way of moving existing debt from one or more credit cards to a single, cheaper card. This step-by-step guide will teach you all the tips and tricks you need to know to help you get out of debt faster and get back to your life. Can I consolidate my credit card debt by transferring the balance? · Check you will not pay more than you need to once the offer expires · Read the terms and. The best way to consolidate credit card debt varies by individual. It largely depends on your financial circumstances and preferences. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan. Federal Student Aid. One method is debt consolidation: You combine your debts “under the same roof” with a better interest rate and a single monthly payment. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover.

The best debt consolidation option gives you a monthly payment you can afford, while reducing the amount of interest you pay. Find your best option here. Is it a good idea to consolidate your debt? A debt consolidation loan will mean you only have one company to pay back each month. But there are some drawbacks. Option 3: Debt management program This is a professionally assisted way to consolidate debt. It's the only solution that works regardless of your credit score. Can I consolidate my credit card debt by transferring the balance? · Check you will not pay more than you need to once the offer expires · Read the terms and. Pay down debt faster and save on interest costs by consolidating your balances into a line of credit or loan with a lower interest rate. The variety of terms, rates and monthly payments can be confusing to manage. Consolidating debt into a single loan can help. With a great rate and a low monthly. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. There are six good options for consolidating debt. Learn the pros and cons of each one and how debt consolidation will improve your financial situation. There are several debt consolidation methods available for various types of debt. For example, credit card debt can be consolidated using a debt consolidation. Debt consolidation is a good way to get on top of your payments and bills when you know your financial situation. If you are not comfortable with the interest rate you'll receive for your debt consolidation loan, you might want to consider using the debt snowball method. A personal loan from a reputable credit union or bank is the most popular way to consolidate significant debt—and for good reason. Typically, a personal loan. There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include: Debt consolidation loan. If you have good credit, consider transferring your credit card debts into a single credit card. Ideally the credit card will have an introductory zero percent. You will need a decent credit score to get approved for a credit card consolidation loan. The better your credit rating, the lower the interest rate. If you. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan. Article Sources. Debt Consolidation Loans of · Best for good to excellent credit: LightStream Personal Loan · Best for fast funding: Upgrade Personal Loan · Best for high. Consolidate debt your way ; Pay down your debts faster. Get rid of debt faster than making minimum payments. ; Customized payment plan. Get in control of monthly. What is the best way to consolidate debt? Let's look at the top three ways to consolidate debt in more detail: Home Equity Loans: You could also consider. Credit card debt consolidation is a good way to get a handle on monthly payments and decrease debt, but it must be done right if you want to do it without.